In the previous posts [1,2] I created script for machine learning stock market price on next day prediction. But it was pointed by readers that in stock market prediction, it is more important to know the trend: will the stock go up or down. So I updated the script to predict difference between today and yesterday prices. If it is negative the stock price will go down, if positive it will go up. Below will be described implemented modifications.

Data inputting

Data from previous days are entered as features through additional columns. The number of columns can be changed through parameter N in the beginning of script. So for example for day 20 the input will contain data for day 21 as target and data for days 20, 19,18,17… 20-N

Also added differencing before scaling. Differencing helped to improve performance of network. It also makes easy to get changes from previous day. In the end the differenced data inverted back.

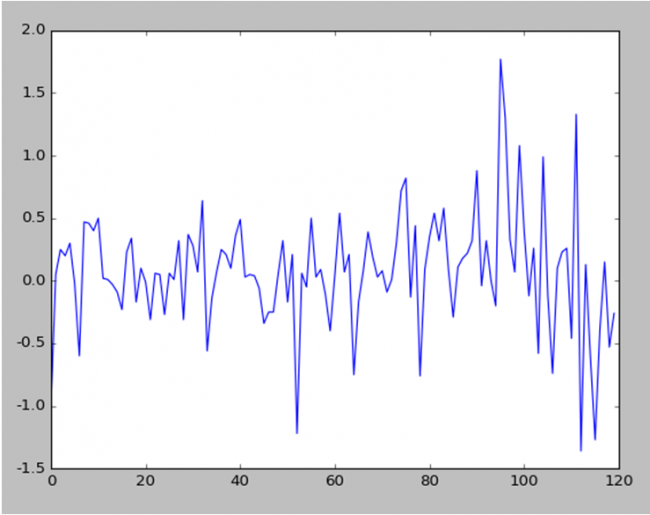

Below is the stock data prices after applying differencing (subtructing previous day stock data price from current day)

Predicting future changes

I used moving_test_window_preds function. Inside of this function the script within loop is adding new prediction to “moving window” array and removing first element from it. This is based on example from blog post on forecasting time series with LSTM[4].

So the script is predicting future day data based on the previous known data in the “moving window”, updating known data and starting again. The performance evaluated by comparing predicted data with test (not used before) data.

LSTM Configuration

The LSTM network is constructed as following:

model = Sequential () input_shape =(len(cols), 1) )) model.add (LSTM ( 400, activation = 'relu', inner_activation = 'hard_sigmoid' , bias_regularizer=L1L2(l1=0.01, l2=0.01), input_shape =(len(cols), 1), return_sequences = False )) model.add(Dropout(0.3)) from keras import optimizers model.add (Dense (output_dim =1, activation = 'linear', activity_regularizer=regularizers.l1(0.01))) adam=optimizers.Adam(lr=0.01, beta_1=0.89, beta_2=0.999, epsilon=None, decay=0.0, amsgrad=True) model.compile (loss ="mean_squared_error" , optimizer = "adam") history=model.fit (x_train, y_train, batch_size =1, nb_epoch =1400, shuffle = False, validation_split=0.15)

Weight regularization together with differencing helped to decrease overfitting.

Results

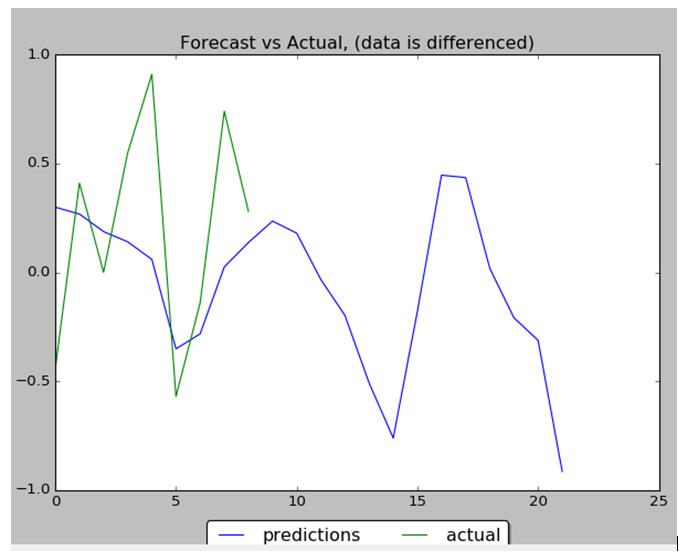

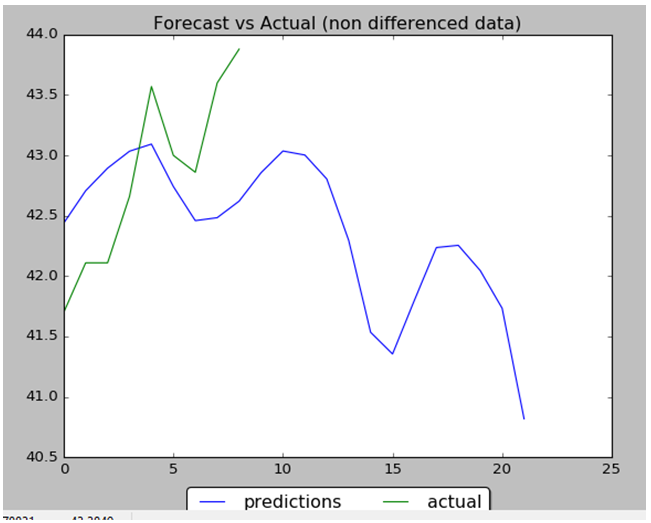

Performance of NN is 88% : 8 correct data out of 9. Below are the data charts that comparing predicted data (9 first days from 22 total days) with actual test data. Below you can find output chart and full python source code.

import numpy as np

import pandas as pd

from sklearn import preprocessing

import matplotlib.pyplot as plt

import matplotlib.ticker as mtick

from keras.regularizers import L1L2

fname="C:\\Users\\Leo\\Desktop\\A\\WS\\stock data analysis 2017\\GM.csv"

data_csv = pd.read_csv (fname)

#how many data we will use

# (should not be more than dataset length )

data_to_use= 150

# number of training data

# should be less than data_to_use

train_end =120

total_data=len(data_csv)

#most recent data is in the end

#so need offset

start=total_data - data_to_use

yt = data_csv.iloc [start:total_data ,4] #Close price

yt_ = yt.shift (-1)

print (yt_)

data = pd.concat ([yt, yt_], axis =1)

data. columns = ['yt', 'yt_']

N=18

cols =['yt']

for i in range (N):

data['yt'+str(i)] = list(yt.shift(i+1))

cols.append ('yt'+str(i))

data = data.dropna()

data_original = data

data=data.diff()

data = data.dropna()

# target variable - closed price

# after shifting

y = data ['yt_']

x = data [cols]

scaler_x = preprocessing.MinMaxScaler ( feature_range =( -1, 1))

x = np. array (x).reshape ((len( x) ,len(cols)))

x = scaler_x.fit_transform (x)

scaler_y = preprocessing. MinMaxScaler ( feature_range =( -1, 1))

y = np.array (y).reshape ((len( y), 1))

y = scaler_y.fit_transform (y)

x_train = x [0: train_end,]

x_test = x[ train_end +1:len(x),]

y_train = y [0: train_end]

y_test = y[ train_end +1:len(y)]

x_train = x_train.reshape (x_train. shape + (1,))

x_test = x_test.reshape (x_test. shape + (1,))

from keras.models import Sequential

from keras.layers.core import Dense

from keras.layers.recurrent import LSTM

from keras.layers import Dropout

from keras import optimizers

from numpy.random import seed

seed(1)

from tensorflow import set_random_seed

set_random_seed(2)

from keras import regularizers

model = Sequential ()

model.add (LSTM ( 400, activation = 'relu', inner_activation = 'hard_sigmoid' , bias_regularizer=L1L2(l1=0.01, l2=0.01), input_shape =(len(cols), 1), return_sequences = False ))

model.add(Dropout(0.3))

model.add (Dense (output_dim =1, activation = 'linear', activity_regularizer=regularizers.l1(0.01)))

adam=optimizers.Adam(lr=0.01, beta_1=0.89, beta_2=0.999, epsilon=None, decay=0.0, amsgrad=True)

model.compile (loss ="mean_squared_error" , optimizer = "adam")

history=model.fit (x_train, y_train, batch_size =1, nb_epoch =1400, shuffle = False, validation_split=0.15)

y_train_back=scaler_y.inverse_transform (np. array (y_train). reshape ((len( y_train), 1)))

plt.figure(1)

plt.plot (y_train_back)

fmt = '%.1f'

tick = mtick.FormatStrFormatter(fmt)

ax = plt.axes()

ax.yaxis.set_major_formatter(tick)

print (model.summary())

print(history.history.keys())

plt.figure(2)

plt.plot(history.history['loss'])

plt.plot(history.history['val_loss'])

plt.title('model loss')

plt.ylabel('loss')

plt.xlabel('epoch')

plt.legend(['train', 'test'], loc='upper left')

fmt = '%.1f'

tick = mtick.FormatStrFormatter(fmt)

ax = plt.axes()

ax.yaxis.set_major_formatter(tick)

score_train = model.evaluate (x_train, y_train, batch_size =1)

score_test = model.evaluate (x_test, y_test, batch_size =1)

print (" in train MSE = ", round( score_train ,4))

print (" in test MSE = ", score_test )

pred1 = model.predict (x_test)

pred1 = scaler_y.inverse_transform (np. array (pred1). reshape ((len( pred1), 1)))

prediction_data = pred1[-1]

model.summary()

print ("Inputs: {}".format(model.input_shape))

print ("Outputs: {}".format(model.output_shape))

print ("Actual input: {}".format(x_test.shape))

print ("Actual output: {}".format(y_test.shape))

print ("prediction data:")

print (prediction_data)

y_test = scaler_y.inverse_transform (np. array (y_test). reshape ((len( y_test), 1)))

print ("y_test:")

print (y_test)

act_data = np.array([row[0] for row in y_test])

fmt = '%.1f'

tick = mtick.FormatStrFormatter(fmt)

ax = plt.axes()

ax.yaxis.set_major_formatter(tick)

plt.figure(3)

plt.plot( y_test, label="actual")

plt.plot(pred1, label="predictions")

print ("act_data:")

print (act_data)

print ("pred1:")

print (pred1)

plt.legend(loc='upper center', bbox_to_anchor=(0.5, -0.05),

fancybox=True, shadow=True, ncol=2)

fmt = '$%.1f'

tick = mtick.FormatStrFormatter(fmt)

ax = plt.axes()

ax.yaxis.set_major_formatter(tick)

def moving_test_window_preds(n_future_preds):

''' n_future_preds - Represents the number of future predictions we want to make

This coincides with the number of windows that we will move forward

on the test data

'''

preds_moving = [] # Store the prediction made on each test window

moving_test_window = [x_test[0,:].tolist()] # First test window

moving_test_window = np.array(moving_test_window)

for i in range(n_future_preds):

preds_one_step = model.predict(moving_test_window)

preds_moving.append(preds_one_step[0,0])

preds_one_step = preds_one_step.reshape(1,1,1)

moving_test_window = np.concatenate((moving_test_window[:,1:,:], preds_one_step), axis=1) # new moving test window, where the first element from the window has been removed and the prediction has been appended to the end

print ("pred moving before scaling:")

print (preds_moving)

preds_moving = scaler_y.inverse_transform((np.array(preds_moving)).reshape(-1, 1))

print ("pred moving after scaling:")

print (preds_moving)

return preds_moving

print ("do moving test predictions for next 22 days:")

preds_moving = moving_test_window_preds(22)

count_correct=0

error =0

for i in range (len(y_test)):

error=error + ((y_test[i]-preds_moving[i])**2) / y_test[i]

if y_test[i] >=0 and preds_moving[i] >=0 :

count_correct=count_correct+1

if y_test[i] < 0 and preds_moving[i] < 0 :

count_correct=count_correct+1

accuracy_in_change = count_correct / (len(y_test) )

plt.figure(4)

plt.title("Forecast vs Actual, (data is differenced)")

plt.plot(preds_moving, label="predictions")

plt.plot(y_test, label="actual")

plt.legend(loc='upper center', bbox_to_anchor=(0.5, -0.05),

fancybox=True, shadow=True, ncol=2)

print ("accuracy_in_change:")

print (accuracy_in_change)

ind=data_original.index.values[0] + data_original.shape[0] -len(y_test)-1

prev_starting_price = data_original.loc[ind,"yt_"]

preds_moving_before_diff = [0 for x in range(len(preds_moving))]

for i in range (len(preds_moving)):

if (i==0):

preds_moving_before_diff[i]=prev_starting_price + preds_moving[i]

else:

preds_moving_before_diff[i]=preds_moving_before_diff[i-1]+preds_moving[i]

y_test_before_diff = [0 for x in range(len(y_test))]

for i in range (len(y_test)):

if (i==0):

y_test_before_diff[i]=prev_starting_price + y_test[i]

else:

y_test_before_diff[i]=y_test_before_diff[i-1]+y_test[i]

plt.figure(5)

plt.title("Forecast vs Actual (non differenced data)")

plt.plot(preds_moving_before_diff, label="predictions")

plt.plot(y_test_before_diff, label="actual")

plt.legend(loc='upper center', bbox_to_anchor=(0.5, -0.05),

fancybox=True, shadow=True, ncol=2)

plt.show()

References

1. Time Series Prediction with LSTM and Keras for Multiple Steps Ahead

2. Machine Learning Stock Prediction with LSTM and Keras

3. Data File

4. Using LSTMs to forecast time-series

You must be logged in to post a comment.